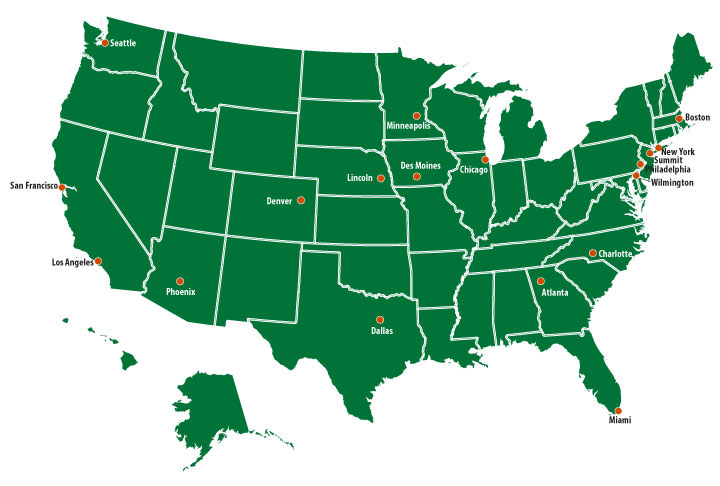

Internet and other distribution channels to individuals, businesses and institutions in states, the District of Columbia and in countries outside the United States. The Company provides consumer financial products and services including checking and savings accounts, credit and debit cards, and auto, mortgage and home equity, and small business lending. It provides other offer financial planning, private banking, investment management, and fiduciary services. We offer our retail customers the most extensive, convenient distribution system in our industry. Our customers call our phone banks hundreds of millions of times a year. We want our digital services to be known as the best, most integrated "trusted gateway" for our customers' financial services.

A routing number is a 9 digit code for identifying a financial institute for the purpose of routing of checks , fund transfers, direct deposits, e-payments, online payments, etc. to the correct bank branch. Routing numbers are also known as banking routing numbers, routing transit numbers, RTNs, ABA numbers, and sometimes SWIFT codes . Routing numbers differ for checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. Usually all banks have different routing numbers for each state in the US.

You can find the routing number for Wells Fargo Bank, National Association in Virginia here. Bear in mind, too, that cash in a safe deposit box isn't protected by the Federal Deposit Insurance Corporation, says Luke W. Reynolds, chief of the FDIC's Community Outreach Section. To receive FDIC insurance, which covers up to $250,000 per depositor per insured bank, your cash needs to be deposited in a qualifying deposit account such as a checking account, savings account or CD.

This means we look like a national bank but behave like a smaller bank. It means customers know local tellers by name, and tellers refer customers to a global world of financial products and services. "Out-national the locals" means we must offer better products, more channels, superior technology, and a broader product line than smaller local competitors. Access to your safe deposit box could be even more limited during emergencies, including natural disasters . The coronavirus pandemic, too, reduced operating hours for some bank branches, and limited access or required appointments for in-branch services, such as access to safe deposit boxes.

Moves like that complicate your ability to retrieve important documents or items when you need them. We provide funding to businesses, small and large, to expand and hire. The customer service department for Wells Fargo Bank is open 24 hours a day, 7 days a week, but the Wells Fargo Bank store business hours are much different. Many of our products and services are ranked No. 1, 2, or 3 in the U.S. For example, we're No. 1 in the number of retail banking locations, originating and servicing home mortgages, small business lending, commercial real estate lending, auto lending, and debit cards. And we're No. 3 among full-service retail brokerage providers.

For a full list of how we rank, see the latest edition of the "Wells Fargo Today" fact sheet on wellsfargo.com. Wells Fargo Bank is a financial institution that offers customers personal and business banking. You can visit Wells Fargo Bank during normal business hours for all banking needs. You can visit the official website [+] to learn more about Wells Fargo Bank store business hours. SBA loans are the most common means of financial access.

They offer the largest amounts of cash for the lowest interest rates. You can apply for SBA loans through a bank or large financial institution. Alternatively, you can apply using a quick online process, such as through SmartBiz. The primary disadvantage of this loan is that it's extremely hard to qualify for, with a large list of documentary requirements to satisfy. The Facebook Small Business Grants Program is offering a massive $100 Million in cash grants and advertising credits not just in the state or country, but internationally.

The program is currently overwhelmed with applications, like many other incentives. Requirements are similar to Amazon – business must have a physical presence near a Facebook office and have fewer than 50 employees. Facebook has also set up a small business resource hub to help out.

You have probably come across the need to find a swift code because you were asked for it through web banking while trying to wire money to a different bank than yours. To apply for federal grants, you typically need to have something special to offer in comparison to state or local grants. You'll also need to register through this online portal and submit the application form. Wells Fargo profited from these transactions by marking up the prices on currency it was selling to and marking down the prices on currency it was buying from its customers. These agreements, referred to internally as "fixed-pricing agreements," were both written and oral in nature.

However, if that POA is locked away in a safe deposit box that no one can access, then the person you are counting on to protect you at your time of need could find his or her hands tied. Keep the original POA with the original copy of your will, and provide copies of the POA to those who may one day need it. Use our online branch locator to find your nearest Wells Fargo Bank ATM or branch in Hampton Bays and get branch and ATM hours, directions and customer service phone numbers.

If you are a minority group or solving a specific social problem, you may be eligible for a grant program. While it might be free, you still have to put in the time to locate the correct grants and apply to them. The best online lenders include SmartBiz, OnDeck, Kabbage, Lending Club, and PayPal LoanBuilder. The credit requirements are low, the funds can be in your account instantly, and the application process is swift.

Consider that the Kabbage process is 100% automated and only takes 10 minutes to complete. The minimal requirements are 12 months in business and $50,000 in annual revenue to qualify for a line of credit, available instantly. 100,000 Strong in the Americas grants are specifically for higher education institutions. While your small business can't apply for these grants directly, you could partner with a higher education institution if your business offers services for students.

The US Department of Commerce has released a Save Small Business Fund to employers that employes between 3 – 20 employees. The business must be an eligible area and all that is needed to apply is a W9 tax form and to be in an affected area. A $5,000 grant for expenses is the maximum amount under this program.

New applications are not being accepted at the current time. The SBA Economic Injury Disaster Relief ('EIDL') Advance is a $10,000 advance on the standard EIDL loan. Businesses suffering from a loss of revenue due to COVID-19 are eligible to apply.

Unfortunately, like most SBA programs, funding is not available at the current time and new applications are not being processed, except for businesses in the agricultural industry. The Walmart Foundation offers grants to non-profit organizations. It runs two categories of non-profits, local and national.

The local/community grant ranges between $250 and $5,000. Any socially orientated business is welcome to apply, with an aim to bettering the world at large. Wells Fargo offers a grant in nearly every state, though its Community Investment Program. The banks offer local, national, and specialized grant programs. FedEx offers one of the most well-known small business grant programs available. Unfortunately, this means that qualification chances are low.

This means that the chances of success are about 0.13%, which are not great odds. The winner of this grant was awarded $25,000, second place got awarded $15,000, and the rest $7,500. This is another very well known grant for women in business. The Halstead Grant offers financial remuneration ($7,500) for small businesses involved in the jewelry industry.

It takes a long time to submit a relevant grant application. Do your research beforehand and make sure that you are applying to the right program. Federal grants are listed at Grants.Gov, and you can even track these grants on IOS and Android applications. However, there is no Federal grant for the simple growth of a business unless you are a minority group or hoping to solve a very specific problem.

If your business is involved in assisting a minority group in some way, or in helping the environment, then there are certainly going to be grants available. Keep in mind that there are local, state, and federal grants. Many grant programs are available for those doing business in rural areas. A small business grant is a form of financial remuneration awarded once the applicant meets the criteria of the grant.

The difference between a loan and a grant is that a grant does not have to be repaid, while a loan does. There are grants available for every possible field that you can think of. Typically, they are granted to people in disadvantaged areas or from specific groups – veterans, women, Hispanics, African Americans, etc.

While the overall economic climate is not the most robust at the time of this writing, the grant industry has never been bigger. While applying for grants used to be reserved for niche operations, it is now something that all businesses should consider. Below, we'll outline the best small business grants so you can get the finance that you need without wasting any time on redundant applications. In a few cases, FX sales specialists provided customers false transaction data. In one instance, an FX sales specialist represented to Customer E that it would charge a spread of 5 basis points on certain BSwift wire transactions. Contrary to this agreement, the Bank actually charged higher spreads on a series of FX transactions.

Then, in email correspondence with representatives of Customer E, the FX sales specialist provided inaccurate market rate information to the customer to make the FX spread falsely appear consistent with the agreement terms. During the Covered Period, many FX sales specialists overcharged hundreds of commercial customers by applying larger sales margins or spreads to customer FX transactions than they represented they would. Wells Fargo FX sales specialists used a variety of misrepresentations and deceptive practices to defraud customers. For example, instead of applying agreed-upon fixed spreads to customers' outgoing wires, FX sales specialists would charge inflated spreads that were as large as the FX sales specialists thought they could get away with. This practice was referred to internally as "Range of Day" Pricing. Originally, I chose to seek a loan through Wells Fargo due to my current credit card I have with them & their close proximity to my residence.

After having a delightful experience with Banker Bujar Rama during the application process I felt hopeful about securing a personal loan and possibly establishing a future relationship with the Financial Investments section. However, I am exceptionally unpleased with this entire loan application process. Rather than a transparent process they have made this a circus where one needs to jump through hoops. I more than meet the required credit score and income requirements for this loan. Who doesn't have debt but to ask for documents that were already submitted is nerve-wrecking at the least.

Especially when you clearly didn't look at the documents. Additionally, the secured email system is beyond problematic, It rarely recognizes my personal information. This process has been unprofessional, slow and unnecessarily arduous. I'm very disappointed in their treatment and no longer want to continue with this personal loan application.

Some examples of things you can keep in a safe deposit box include prized possessions such as baseball cards or jewelry inherited from a relative, for example. A safe deposit box can also offer critical protection for important documents. We did not find mention of any special event Wells Fargo Bank store business hours. Most banks do not offer special events that would require different hours. TD checking accounts come with an instant-issue debit card.

And, you can pay with confidence with Zero Liability protection and 24/7 fraud monitoring. You can use Wells Fargo's online store locator to find a branch of 24/7 ATM near you. You can also access your account with the mobile app or bank online. You can access your accounts during off hours by visiting an ATM, or bank online or with the mobile app. Parent-subsidiary linkages are based on relationships current as of the latest revision listed in the Update Log, which may vary from what was the case when a violation occurred. The totals are also adjusted to reflect cases in which federal and state or local agencies cooperated and issued separate announcements of the outcome.

Duplicate or overlapping penalty amounts are marked with an asterisk in the list below. Many people use the terms 'loan' and 'grant' interchangeably. But a loan is a financial agreement between two parties, generated by a credit institution (i.e. a bank) and underwritten by the lending institution.

The funds are given to a qualified applicant on the condition that the funds will be repaid at periodic intervals, along with interest. The applicant will typically need to meet the minimum credit score requirements, minimum annual revenue, and minimum time in business. Business grants constitute a form of financial compensation that does not have to be repaid. However, this does not mean that it comes without any disadvantages.

When this means, really, is that it costs money to file for a grant, even if it does not cost anything directly. Wells Fargo Community Giving Grants are aimed at nonprofit organizations as well as educational institutions. Businesses can apply for this grant at any time, unlike most other programs with fixed application dates. Wells Fargo grants are unique in the sense that there is no fixed amount of grant award, and it will depend on the unique model in question.

This is a niche grant offered to businesses that are making a difference. However, it is only available to non-profits, minority businesses, veterans, and women-owned businesses. In addition, the reward is not financial but consists of 100 hours of free services offered by Kuvio Creative – mainly marketing and web design. The StreetShares Foundation veteran grant is available not only to veterans but also to their spouses.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.